Growth Strategies Adopted by Major Players in the Frozen Foods Market

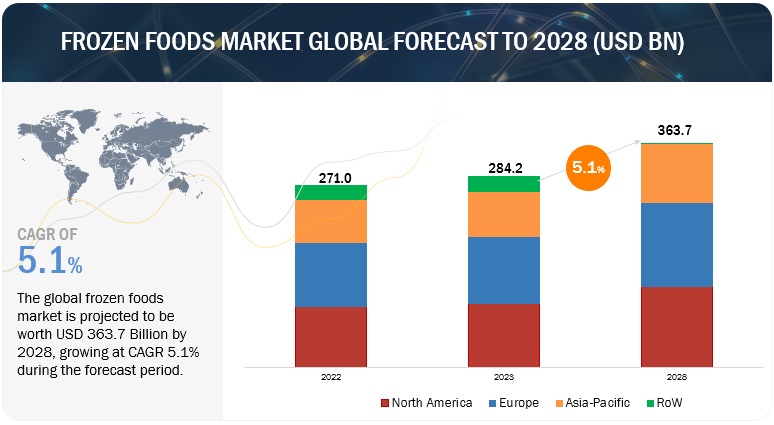

The global frozen foods market is estimated at USD 284.2 billion in 2023 and is projected to reach USD 363.7 billion by 2028, at a CAGR of 5.1% from 2023 to 2028. The primary key factor contributing to the growing demand for frozen foods is convenience. In today's fast-paced world, consumers are constantly seeking time-saving solutions that fit their busy lifestyles. Frozen foods offer a hassle-free way to put meals on the table without the lengthy preparation associated with fresh ingredients. This convenience factor resonates with a wide spectrum of consumers, from working professionals and busy families to students and seniors. Frozen foods provide a quick and efficient means of meal preparation, allowing individuals to enjoy a wide variety of options without sacrificing taste or nutritional value. The ease of storage and longer shelf life compared to fresh foods further enhances their appeal. As a result, the convenience factor remains the driving force behind the sustained and growing demand for frozen foods in the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=130

The online distribution channel segment is expected to grow at the highest CAGR during the forecast period.

The online distribution channel is experiencing the fastest growth in the frozen foods market due to several significant factors. Firstly, the rise of e-commerce has transformed the way consumers shop for groceries. Online platforms offer a convenient and accessible way to browse and purchase frozen food products from the comfort of one's home, eliminating the need for physical store visits. Secondly, the COVID-19 pandemic accelerated the adoption of online grocery shopping, with consumers prioritizing safety and social distancing. Many people who had not previously used online grocery services became accustomed to the convenience, and this shift in behavior has persisted. Thirdly, online platforms provide a wider variety of frozen food options, including niche and specialty products, which may not be readily available in brick-and-mortar stores. This expanded selection caters to diverse consumer preferences and dietary needs, further driving online sales. Moreover, the ability to read product reviews, compare prices, and access personalized recommendations online enhances the overall shopping experience, making it more appealing to consumers.

By consumption, food service holds the largest in the frozen foods market in 2023.

The substantial presence of the food service sector in the frozen foods market can be attributed to several compelling factors. To begin with, the food service industry, encompassing restaurants, hotels, cafeterias, and catering services, heavily depends on the convenience and adaptability offered by frozen food ingredients. Frozen foods ensure a uniform level of quality and enable precise portion control, enabling food service establishments to optimize their operations while delivering consistently delicious meals to their patrons. Furthermore, frozen foods play a pivotal role in curbing food wastage within the food service sector. They boast extended shelf lives in comparison to fresh ingredients, reducing the chances of spoilage and financial losses, a critical consideration in a fast-paced, high-volume industry. Moreover, the extensive array of frozen food choices, spanning appetizers, side dishes, main courses, and desserts, grants food service operators the flexibility needed to cater to a diverse array of customer tastes and dietary needs.

Get 10% Free Customization on this Report:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=130

Germany is expected to account for the largest market share in 2023.

Germany is poised to dominate the frozen foods market for several compelling reasons. The nation's strong economy and high levels of consumer purchasing power make it an attractive hub for frozen foods. Additionally, Germany's shifting demographics, characterized by a growing number of working professionals and single-person households, fuel the demand for convenient meal solutions. Frozen foods are well-aligned with these changing consumer preferences, offering quick and effortless preparation options. Furthermore, Germany places a significant emphasis on food safety and quality, and frozen foods are perceived as a secure and dependable choice. This trust in the quality and safety of frozen products further solidifies their dominance in the market. Alongside, the German market has experienced a surge in health-conscious consumers seeking frozen fruits, vegetables, and other healthier alternatives. This health-oriented trend has propelled the growth of the frozen foods market, especially within the healthier product segments. Germany is in the final stages of developing its National Nutrition Strategy, which includes a significant focus on promoting a shift towards plant-based foods within its food system. This shift aims to enhance the overall health of the population while also reducing the environmental impact on the climate. As part of this strategy, Germany has set ambitious goals to be achieved by 2030, including the aim to source 30 percent of its agricultural products from organic farming practices. Additionally, the country intends to cut food waste by 50 percent across all sectors. This aligns with Germany's commitment to healthier and more sustainable food choices, making it a key driver for the growth of the frozen foods market, particularly in healthier segments like frozen fruits and vegetables.

Major players operating in the frozen foods market are General Mills Inc. (US), Nestlé (Switzerland), Unilever (Netherlands), McCain Foods Limited (Canada), Conagra Brands, Inc (US), Kellogg's Company (US), Grupo Bimbo (Mexico), and The Kraft Heinz Company (US).