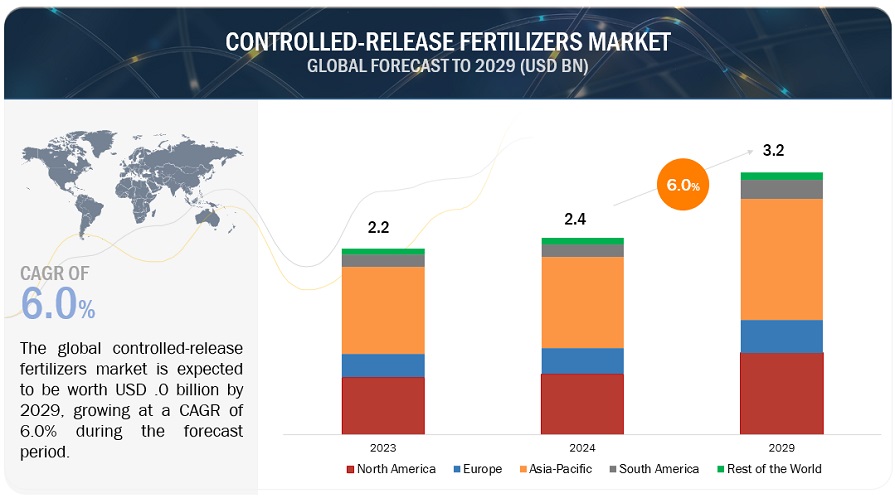

Controlled-release Fertilizers Market to Showcase Continued Growth in the Coming Years

The global Controlled-release fertilizers market is projected to reach USD 2.9 billion by 2028 from USD 2.2 billion by 2023, at a CAGR of 5.9% during the forecast period in terms of value. The controlled-release fertilizers market has witnessed significant growth and established its dominance in the global agriculture industry. According to the World Bank Report 2023, approximately 9.2% of the world’s population faced hunger in 2022, compared with 7.9% in 2019. The rising levels of hunger and food insecurity highlight the urgent need to increase agricultural productivity to ensure food availability. Thus, the increasing demand for enhanced agricultural output while reducing environmental effects is one of the main driving factors. These fertilizers deliver nutrients gradually, enhancing plant absorption while lowering leaching and runoff, which helps reduce water pollution. Furthermore, the use of controlled-release fertilizers is accelerated by the push for sustainable agricultural practices, which are complementary to their advantages.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

Opportunities: Crop-specific nutrient management through precision farming practices

Crop-specific nutrient management through precision farming practices presents significant opportunities for the controlled-release fertilizers market. Precision farming, which involves using technology to tailor agricultural practices to the specific needs of different crops, synergized with controlled-release fertilizers to enhance efficiency, productivity, and sustainability in agricultural operations.

Precision farming allows for the fine-tuning of nutrient requirements for different crops. Controlled-release fertilizers can be formulated to release nutrients in accordance with specific crop growth stages, ensuring optimal nutrient availability when needed most. Precision farming minimizes over-fertilization by applying nutrients only where and when needed. Controlled-release fertilizers further reduce wastage by delivering nutrients gradually and minimizing runoff.

Nitrogen Stabilizers is one of the Controlled-Release Fertilizer Types Which Accounted Second Highest Market Share in 2022

Nitrogen stabilizers are gaining popularity in the agricultural market due to their ability to improve nitrogen use efficiency and reduce nitrogen losses to the environment. Nitrogen is a vital nutrient for plant growth, but it can be easily lost from the soil through processes like leaching (movement of nutrients with water through the soil profile) and denitrification (conversion of nitrate into gaseous forms). Nitrogen stabilizers are additives that can be combined with traditional fertilizers to slow down the conversion of ammonium-based fertilizers into nitrates, thus reducing nitrogen losses.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=136099624

China is one of the Largest Growing Markets for Controlled-Release Fertilizers in Asia Pacific

China is one of the most populated nations in the world due to its enormous population. Due to the large consumer base, there is a strong increasing demand for food and with a large population to feed and limited arable land, necessitates high agricultural productivity. To achieve this, there's a growing emphasis on optimizing nutrient management to enhance crop yields. According to the China Briefing news, China's median disposable income per capita reached RMB 31,370 in 2022, a year-year-on-year increase of 4.7 percent. Thus, as income levels rise in China, there is a shift in dietary preferences toward higher-quality foods, including fruits, vegetables, and protein-rich products. This demand for quality necessitates better nutrient management and higher crop yields, which controlled-release fertilizers can provide. For example, in China, CRF was classified as one of the encouraged items in the guiding catalog of Industrial Infrastructure Adjustment (2011 edition), indicating that its development should be accelerated during China’s 13th five-year plan from 2016 to 2020. This plan calls for a reduction in the use of pesticides and fertilizers and the implementation of water and food control and safety management. Over the last 15 years, the use of CRF has grown at a rate of 5.7% in the country. These government policies and well-defined regulations serve as boosting factors for the global growth of this market.

The key players in this market include Yara (Norway), Nutrien Ltd. (Canada), Mosaic (US), ICL (Israel), Nufarm (Australia), Kingenta (China), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemicals (US), and SQM (Chile).